Thursday’s big stock stories: What’s likely to move the market in the next trading session

Here's what manufacturers were watching as stocks rose on Wednesday and what to expect in the coming trading session.

Retail in the U.S.A.

- While Target and TJX reported positive news that boosted the stocks’ prices Wednesday — with TJX getting a 6% bump and Target an 11% jump — we’re turning our attention to the mall real estate investment trusts.

- Retail earnings this season — including Target, TJX and Macy’s , which fell nearly 13% in Wednesday’s session — all indicated a Great American Consumer who is becoming more cautious.

- Kimco and Simon Property Group both rose more than 1% Wednesday.

- Both stocks are up about 5% in August, and both hit new highs this week.

- Brixmor , which operates open-air shopping centers, hit a new high Wednesday. The stock is up 9% in a month.

- Tanger , the outlet mall operator, is 4% from the 52-week high hit back in March. The stock is up 2.6% week to date and up 24% in the past year.

Canada

- Ahead of a possible rail strike in Canada, shares of Canadian National Railway are 15% from the March high. The stock is down about 10% in three months.

- Canadian Pacific Kansas City is 13% from the March high. The stock is flat in 2024.

- Norfolk Southern is 8% from the March high. Shares are up 7.5% in three months.

- Both stocks are up about 5% in August, and both hit new highs this week.

- Union Pacific is 5% from the February high. Shares are almost exactly flat in 2024.

- CSX is 16% from the February high.

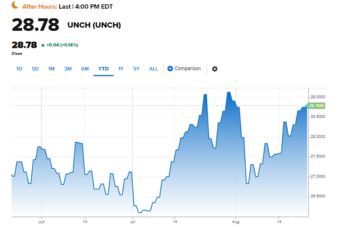

Brent crude

- The commodity is now negative for the year after falling 1.5% on Wednesday.

- West Texas Intermediate crude is up 0.4% in 2024.

- The S&P 500 energy sector is up 5.7% this year. Only the real estate sector ranks below it.

- Exxon Mobil is up about 14% in 2024.

- Chevron is down 2.6% in 2024.

Eiusmod tempor incididunt ut labore et dolore magna aliqua. Photos via link

Topics:

Don't miss a story

Subscribe to our email newsletter:

Don't worry we hate spam as much as you do